Survival or Extinction: Part Seven—Power Of Money

| 27 Oct 2014: posted by the editor - Features | |

|

Survival or Extinction: Part Seven—Power Of Money To be able to pay for resources rather than take them by force, a system was created to recognize the value of each national currency and to facilitate trade between nations by allowing international financial transactions to take place as orderly and smoothly as national financial transactions. Bretton Woods was in other words the first and most important step towards an integrated global economy. The Bretton Woods order gave the US dollar a central role, as the currency of global trade. To engage in international trade every nation needed henceforth to buy dollars before it could buy goods, resources or services from other nations. The US dollar therefore became the reserve currency of choice and the United States needed to print more money than any other nation on earth in order to satisfy the global demand for its dollars. According to this arrangement, countries fixed their exchange rates relative to the US dollar and central banks could exchange their dollar holdings into gold at the official exchange rate of $35 per ounce, so that all currencies pegged to the dollar had a fixed value in terms of gold. In time, however, the burden on America to back up with gold the vast amounts of dollars it issued in order to facilitate global trade became too great and the US was forced to abandon the gold standard. Henceforth currencies became detached from gold, thus from any fixed asset. Such currencies are known as “fiat money”, which means money with no intrinsic value. All currencies in the world today are fiat money. The notion that fiat currencies can be abandoned for a return to the gold standard is retarded for the simple reason that we would need the gold of three planets to back up the value of all currencies, which in turn represent the value of each nation’s entire economic activity. Fiat currencies came into being in the early 1970s for the very reason that there was insufficient gold to ensure the convertibility of the Deutsch Mark and U.S. Dollar (then the primary reserve currencies of the world) to gold. It should be remembered that while gold output growth since 1950 has kept pace with world population growth, both having doubled, it has fallen behind world economic growth by at least eight times. Money has no intrinsic value other than that agreed upon by convention. To agree upon the value of money, therefore, requires trust in the system and faithful and universal respect for its rules by every nation on earth. If one breaks the rules the entire system crashes. Physical money covers only a very small percentage of the overall economic activity. allows for central control (which is needed for a global economy and civilization); ensures a smoother economic flow, unimpeded by the act of physically exchanging money (which further integrates the world and eliminates waste and inefficiencies); paves the way to a painless transition to a global currency since there is no emotional attachment to a physical entity (which is the final step towards a world united). Economic integration has advanced step in step with monetary integration, one being impossible without the other. from physical currency……………………………..to abstract currency, from national control………………………………..to international control, from serving national interests……………………....to serving global interests. SPEDRI is the unit of account of the International Monetary Fund (IMF) and it is not a currency per se but a claim to a currency held by IMF member countries. It is in effect a basket of currencies and has the potential to replace the US dollar as the world’s reserve currency.

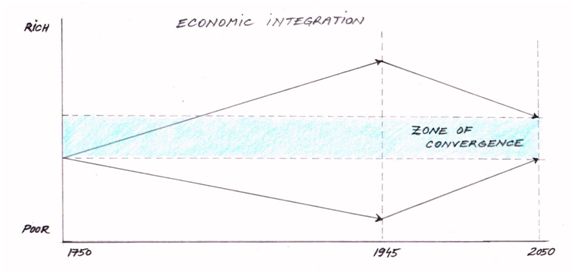

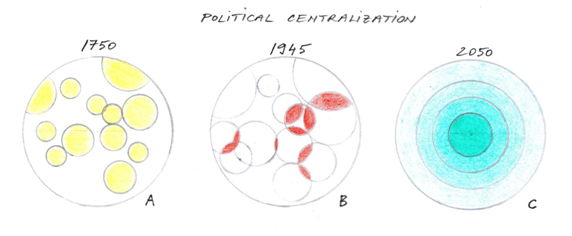

Will the transition to full global integration be painful? A third sign is that China is being allowed to redefine the global economic monetary system by establishing its currency, the yuan, as an international currency reserve, therefore challenging the supremacy of the euro and dollar, which currently account for 40% and 34% respectively of global payments. Once the US dollar ceases to be the world’s currency, the economic advantages and with them the military supremacy of the United States will disappear virtually overnight. The US dollar has already lost ground to the Euro, which in only fourteen years since its inception has displaced the dollar as the currency with the most banknotes and coins in circulation (as of November 2013), is the second largest reserve currency, and the second most traded currency in the world. There has been no agreement to date on how to reform the Security Council to uproot the power of the original five and thus achieve a truly democratic global power structure that advances global rather than upholds national interests. The last step in the long and arduous process of unifying the world demands new institutions, institutions that are independent of nation states and are free to pursue global interests that are common to all of humanity. Economic integration In graphic terms this process looks like this: Explanation: The vertical axis represents wealth and the horizontal axis represents time. Prior to the Industrial Revolution people across the world had approximately the same standard of living as agrarian societies. Western nations were first to industrialize and improve their standard of living by creating increasingly more material goods and exploiting more natural resources per capita. Political centralization In graphic terms this process looks like this:

Explanation: The concentric circles represent nations. Demographic limitation Killing Us Softly: Causes and Consequences of the Global Depopulation Policy is considered by the author to be important in understanding the content of Survival or Extinction. Likewise a second book, Chemical and Biological Depopulation is also considered important to understanding. You can download both as a zipfile here Tags: Survival or Extinction |

|

|

|

| Name: | Remember me |

| E-mail: | (optional) |

| Smile: | |

| Captcha | |